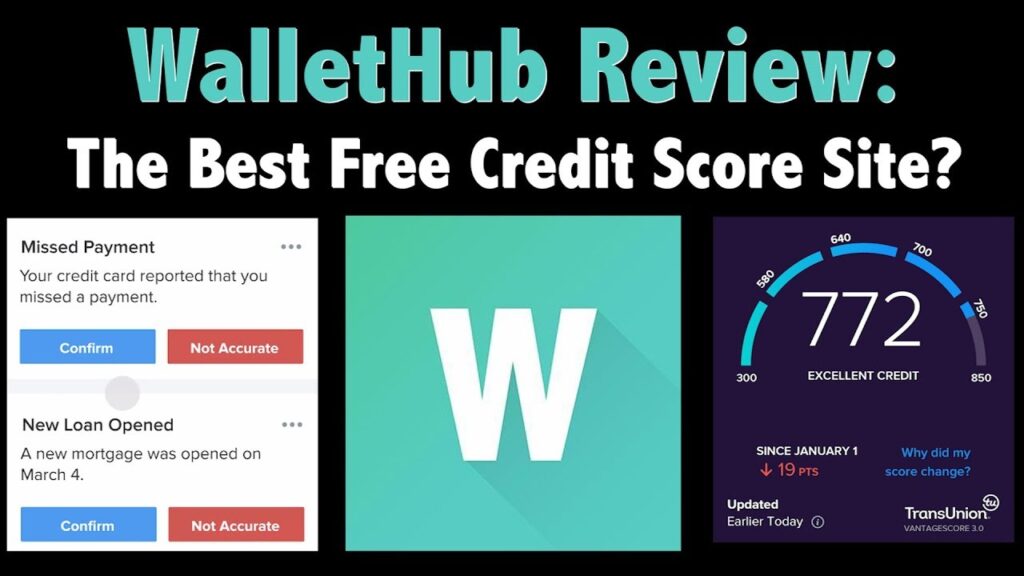

كثير من الناس ما كيعرفوش أن بطاقة الائتمان أو البنك اللي كيتعاملوا معه، ممكن ما يكونش أفضل اختيار ليهم. WalletHub كيعطيك تقييم شامل لكل المنتجات المالية، باش تعرف نقاط القوة والضعف قبل ما تختار.

ماذا يقدم WalletHub؟

- تقييم البنوك والبطاقات الائتمانية.

- نصائح لتحسين تقييمك الائتماني.

- أدوات مقارنة ذكية بين العروض.

كيف يساعدك؟

تقدر تدخل معلوماتك، والموقع يعطيك أفضل الخيارات حسب وضعك المالي، بدل ما تضيع وقتك في البحث العشوائي.

القيمة المضافة

كيختصر عليك البحث ويعطيك توصية شخصية مبنية على بياناتك الفعلية.

الخلاصة

مع WalletHub، قراراتك المالية تولي مبنية على تحليل وخبرة، مشي على الصدفة.

WalletHub – Make Smarter Financial Decisions with Expert Ratings

Introduction

In today’s fast-paced world, making the right financial decisions can be overwhelming. With hundreds of credit cards, loans, and financial services available, how do you know which option truly fits your needs? That’s where WalletHub comes in. As a free personal finance platform, WalletHub provides expert ratings, powerful comparison tools, and personalized advice to help you take full control of your financial journey. Whether you’re building credit, looking for the best loan, or simply managing your money better, WalletHub is designed to make the process smarter and easier.

What is WalletHub?

WalletHub is a personal finance website and app that offers users access to free tools, resources, and expert reviews to guide financial decisions. The platform specializes in comparing a wide range of financial products such as credit cards, personal loans, auto loans, insurance, and even credit scores. Its mission is simple: to help users save money and make smarter choices when dealing with their finances.

Key Features of WalletHub

- Expert Ratings & Reviews ⭐

WalletHub’s team of experts thoroughly reviews financial products and services, providing unbiased ratings. These ratings allow users to quickly see the strengths and weaknesses of each option without drowning in complicated financial jargon. - Credit Card Comparisons 💳

One of WalletHub’s standout features is its detailed credit card comparison tool. From rewards cards to balance transfer cards, WalletHub breaks down fees, APRs, and benefits so you can choose what’s best for your lifestyle. - Loan and Insurance Options 🏦

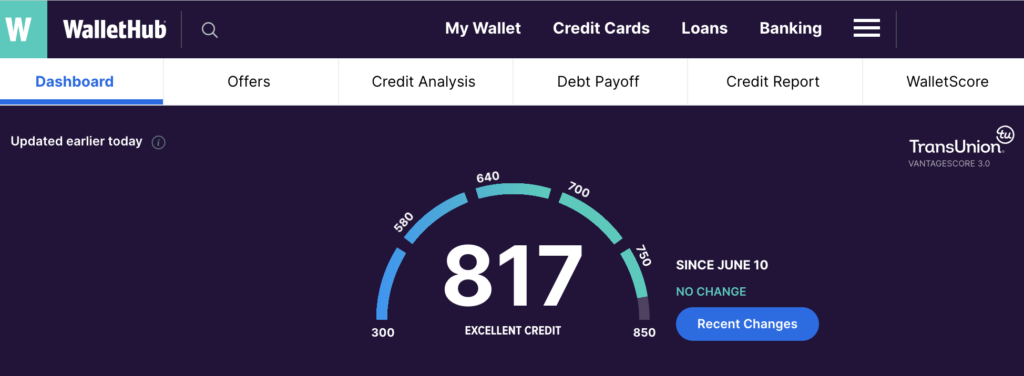

Beyond credit cards, WalletHub helps you compare personal loans, mortgages, auto loans, and insurance policies, ensuring you get the most competitive rates. - Free Credit Scores and Reports 📊

WalletHub provides free access to your credit score and updates it daily — something that sets it apart from many other platforms. Monitoring your credit regularly helps you stay financially healthy. - Personalized Recommendations 🎯

Based on your profile, WalletHub suggests the best financial products tailored to your needs, making it easier to achieve your goals.

Why Choose WalletHub?

- Saves Time and Effort ⏳ – Instead of visiting multiple bank websites, WalletHub centralizes all the information you need in one place.

- Trusted Expert Insights 👩💼 – With professional ratings and reviews, you can rely on WalletHub to guide you towards the smartest financial decision.

- Completely Free 🆓 – Unlike some competitors, WalletHub offers its services at no cost.

- Educational Resources 📚 – The platform also provides guides, tips, and financial advice for better money management.

Who Should Use WalletHub?

- Students 🎓 – Looking for the right first credit card.

- Families 👨👩👧 – Seeking affordable insurance or loan options.

- Travelers ✈️ – Comparing rewards cards with travel benefits.

- Anyone 💡 – Who wants to monitor credit scores and make more informed financial decisions.

Conclusion

WalletHub is more than just a comparison tool; it’s a financial compass that helps you navigate the complicated world of money management. With its expert ratings, personalized recommendations, and free financial tools, you’ll be empowered to make smarter decisions and save money along the way.

If you’re ready to take control of your financial future, WalletHub is the perfect place to start. It’s like having a financial advisor right in your pocket — only better, because it’s free.